In today’s fast-paced world, the concept of passive income has gained significant traction among individuals seeking financial freedom. You may have heard the term before, but what does it truly mean? Passive income refers to earnings derived from ventures in which you are not actively involved on a day-to-day basis.

Unlike traditional employment, where you trade your time for money, passive income allows you to generate revenue with minimal ongoing effort. This can be a game-changer for your financial landscape, enabling you to focus on other pursuits while your money works for you. The allure of passive income lies in its potential to create a sustainable financial future.

Imagine waking up each day knowing that your bank account is growing, even while you sleep. This financial independence can provide you with the freedom to pursue your passions, travel, or spend more time with loved ones. However, it’s essential to understand that building a reliable stream of passive income often requires an initial investment of time, effort, or capital.

As you explore various avenues for generating passive income, you’ll discover that the right strategy can lead to long-term financial stability and peace of mind.

Key Takeaways

- Passive income is money earned with minimal effort through various streams such as affiliate marketing, digital products, property rental, dividend stocks, peer-to-peer lending, and content creation.

- Affiliate marketing involves promoting products or services and earning a commission for each sale made through your unique affiliate link.

- Creating and selling digital products, such as e-books, online courses, or software, can generate passive income through recurring sales.

- Renting out property, whether it’s a vacation home, apartment, or commercial space, can provide a steady stream of passive income through rental payments.

- Investing in dividend stocks allows investors to earn a portion of the company’s profits, typically paid out quarterly, without actively managing the investment.

Affiliate Marketing

One of the most popular methods for generating passive income is affiliate marketing. This approach allows you to earn commissions by promoting products or services offered by other companies. You can leverage your online presence—whether through a blog, social media, or a website—to share affiliate links with your audience.

This model can be incredibly lucrative if executed correctly, as it requires minimal upfront investment and can be scaled over time. To succeed in affiliate marketing, it’s crucial to choose a niche that resonates with your interests and expertise.

By focusing on a specific area, you can build a loyal audience that trusts your recommendations. Additionally, creating high-quality content that provides value to your readers will enhance your credibility and increase the likelihood of conversions. As you establish yourself as an authority in your niche, you may find that your affiliate income grows steadily, allowing you to enjoy the benefits of passive revenue.

Creating and Selling Digital Products

Another effective way to generate passive income is by creating and selling digital products. This could include e-books, online courses, printables, or software applications. The beauty of digital products lies in their scalability; once you’ve created a product, it can be sold repeatedly without incurring additional production costs.

This means that after the initial effort of creating the product, you can continue to earn money with little ongoing work. To embark on this journey, start by identifying a problem that your target audience faces and develop a solution in the form of a digital product. Conduct market research to understand what types of products are in demand and how you can differentiate yours from the competition.

Once your product is ready, utilize various marketing strategies—such as social media promotion, email marketing, and search engine optimization—to reach potential customers. With dedication and creativity, you can build a successful passive income stream through digital products that not only provides financial rewards but also allows you to share your knowledge and expertise with others.

Renting Out Property

If you have the means to invest in real estate, renting out property can be an excellent source of passive income. Owning rental properties allows you to earn monthly rent from tenants while potentially benefiting from property appreciation over time. This investment strategy requires careful planning and management but can yield substantial returns if executed properly.

Before diving into the world of real estate investing, it’s essential to conduct thorough research on the housing market in your desired location. Consider factors such as property values, rental demand, and local regulations that may impact your investment. Once you acquire a property, you can choose to manage it yourself or hire a property management company to handle day-to-day operations.

By ensuring that your property is well-maintained and appealing to tenants, you can create a steady stream of passive income while building equity in your investment.

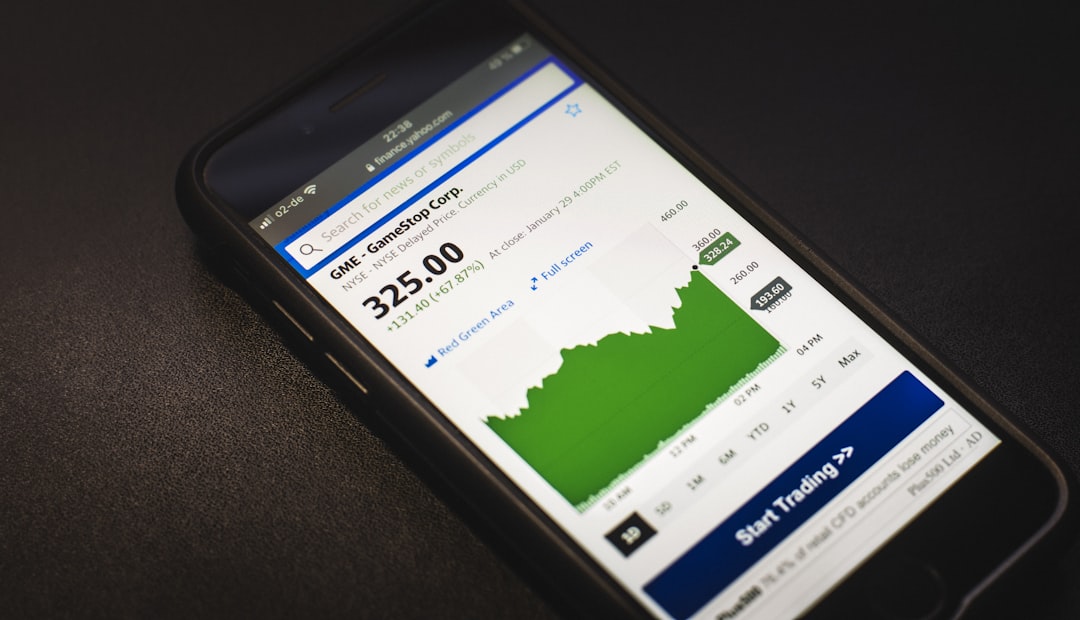

Investing in Dividend Stocks

Investing in dividend stocks is another viable option for generating passive income. Dividend stocks are shares in companies that distribute a portion of their earnings back to shareholders in the form of dividends. By building a diversified portfolio of dividend-paying stocks, you can create a reliable source of income that grows over time as companies increase their dividend payouts.

To get started with dividend investing, research companies with a strong track record of paying dividends consistently. Look for businesses with solid fundamentals and a history of increasing their dividends annually. By reinvesting your dividends back into purchasing more shares, you can take advantage of compound growth and significantly boost your passive income over time.

While investing in stocks carries inherent risks, a well-researched approach can lead to substantial financial rewards and long-term wealth accumulation.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending has emerged as an innovative way to generate passive income by connecting borrowers with individual lenders through online platforms. As a lender, you can earn interest on the money you lend to borrowers seeking personal loans or business financing. This method allows you to diversify your investment portfolio while potentially earning higher returns than traditional savings accounts or bonds.

To participate in P2P lending, start by selecting a reputable platform that aligns with your investment goals. Review borrower profiles and assess their creditworthiness before deciding how much to lend. By spreading your investments across multiple loans, you can mitigate risk while maximizing potential returns.

While P2P lending offers attractive opportunities for passive income, it’s essential to remain aware of the risks involved and conduct thorough research before committing your funds.

Creating and Monetizing a Blog or YouTube Channel

In the digital age, creating and monetizing a blog or YouTube channel has become an increasingly popular avenue for generating passive income. By sharing your knowledge, experiences, or passions through engaging content, you can attract an audience and monetize your platform through various means such as advertising, sponsorships, or affiliate marketing. To embark on this journey, choose a niche that excites you and resonates with potential viewers or readers.

Consistently produce high-quality content that provides value and engages your audience.

Building a successful blog or channel takes time and dedication; however, once established, it can serve as a powerful source of passive income that continues to generate revenue long after the content is created.

Conclusion and Tips for Success

In conclusion, passive income offers an exciting opportunity for individuals seeking financial independence and flexibility in their lives. Whether through affiliate marketing, digital products, real estate investments, dividend stocks, peer-to-peer lending, or content creation, there are numerous avenues available for generating revenue without constant active involvement. However, success in these ventures requires careful planning, research, and dedication.

As you embark on your journey toward building passive income streams, remember these essential tips: Start small and gradually scale up as you gain experience; diversify your income sources to mitigate risk; stay informed about market trends and changes; and remain patient—building substantial passive income takes time and effort. By staying committed to your goals and continuously learning along the way, you can create a sustainable financial future that allows you to enjoy life on your terms.

If you’re interested in learning more about passive income opportunities, you may want to check out MoneyCheck’s article on The Ultimate Guide to Passive Income Streams. This comprehensive guide covers various ways to generate passive income, including investing, real estate, and online businesses. By combining the insights from both articles, you can gain a better understanding of how to build a diversified portfolio of passive income streams with little to no upfront costs.

FAQs

What is passive income?

Passive income is income that is earned with little to no effort on the part of the recipient. It is typically generated from investments, rental properties, or other sources that require minimal ongoing work.

What are some ways to earn passive income with no upfront costs?

Some ways to earn passive income with no upfront costs include affiliate marketing, creating and selling digital products, renting out a room or property, investing in dividend stocks, and creating a YouTube channel.

How does affiliate marketing work as a source of passive income?

Affiliate marketing involves promoting products or services and earning a commission for each sale or lead generated through your referral. It requires no upfront costs and can be done through various online platforms.

What are some examples of digital products that can be created and sold for passive income?

Examples of digital products that can be created and sold for passive income include e-books, online courses, stock photos, and printables. These products can be created once and sold repeatedly without incurring additional costs.

How can renting out a room or property generate passive income with no upfront costs?

Renting out a room or property through platforms like Airbnb or VRBO can generate passive income without requiring any upfront costs. Homeowners can earn money from their unused space and have the flexibility to set their own rental terms.

What are dividend stocks and how can they generate passive income with no upfront costs?

Dividend stocks are shares of companies that pay out a portion of their profits to shareholders on a regular basis. By investing in dividend stocks, individuals can earn passive income without any upfront costs and benefit from potential long-term growth.