Passive income refers to the earnings you generate with minimal effort or active involvement. Unlike traditional income, which requires you to trade your time for money, passive income allows you to earn money while you sleep, travel, or engage in other activities. This concept is crucial in today’s fast-paced world, where financial security and freedom are increasingly sought after.

By establishing multiple streams of passive income, you can create a safety net that protects you from economic downturns and unexpected expenses. The importance of passive income lies in its ability to provide financial stability and independence. It allows you to break free from the constraints of a 9-to-5 job, giving you the freedom to pursue your passions or spend more time with loved ones.

Moreover, passive income can serve as a powerful tool for wealth accumulation. By reinvesting your earnings, you can grow your financial portfolio over time, leading to greater opportunities and a more comfortable lifestyle. In essence, passive income is not just about making money; it’s about creating a life where you have the freedom to choose how you spend your time.

Key Takeaways

- Passive income is important because it allows you to earn money with minimal effort and time investment, providing financial stability and freedom.

- Real estate investing can be a lucrative passive income stream through rental properties or real estate investment trusts (REITs).

- Dividend stocks and bonds can provide regular passive income through regular payouts and interest payments.

- Creating and selling digital products such as e-books, online courses, or stock photography can generate passive income.

- Building a blog or YouTube channel can generate passive income through advertising, sponsorships, and affiliate marketing.

- Peer-to-peer lending can provide passive income through interest payments on loans to individuals or businesses.

- Renting out property or space, such as a spare room or parking space, can generate passive income.

- Diversifying passive income streams is important to minimize risk and maximize potential earnings.

Real estate investing as a passive income stream

Real estate investing is one of the most popular avenues for generating passive income. By purchasing rental properties, you can earn a steady stream of income through monthly rent payments. This investment strategy not only provides cash flow but also offers the potential for property appreciation over time.

As property values increase, so does your equity, which can be leveraged for further investments or used to secure loans for other ventures. However, it’s essential to approach real estate investing with careful planning and research. You need to consider factors such as location, property management, and market trends.

While owning rental properties can be a lucrative source of passive income, it does require some initial effort in terms of finding the right property and managing tenants. Many investors choose to hire property management companies to handle day-to-day operations, allowing them to enjoy the benefits of real estate without the associated headaches. This way, you can truly make your investment work for you while focusing on other aspects of your life.

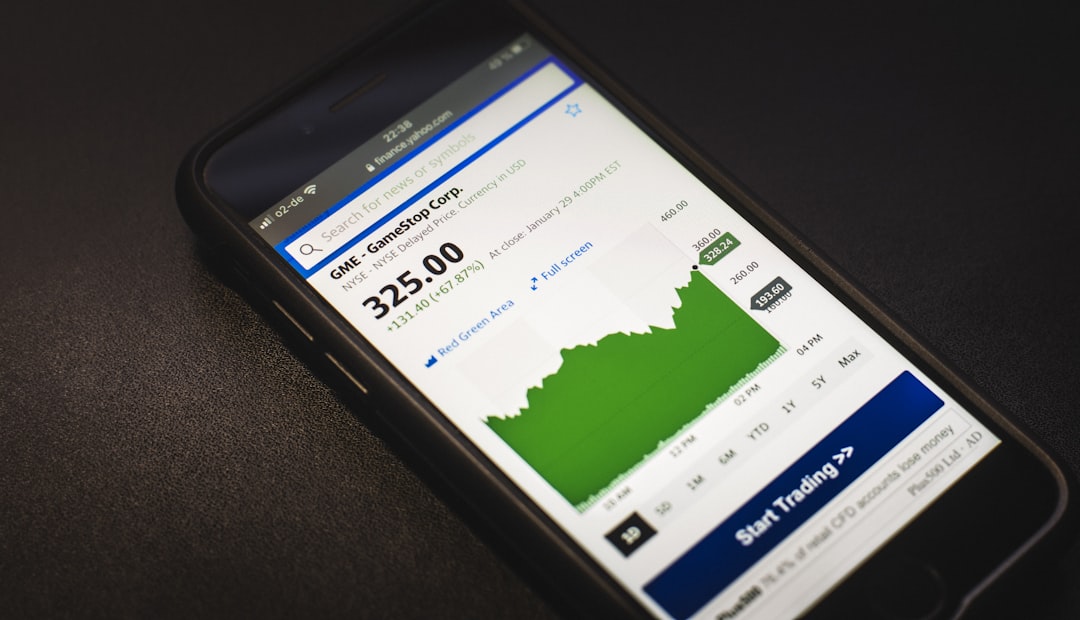

Dividend stocks and bonds for passive income

Investing in dividend stocks and bonds is another effective way to generate passive income. Dividend stocks are shares in companies that distribute a portion of their earnings back to shareholders in the form of dividends. This means that not only do you benefit from potential stock price appreciation, but you also receive regular cash payments.

By building a diversified portfolio of dividend-paying stocks, you can create a reliable income stream that grows over time as companies increase their dividends. Bonds, on the other hand, are fixed-income securities that pay interest over a specified period.

While bonds typically offer lower returns compared to stocks, they provide stability and can be an excellent addition to your passive income strategy. By balancing your investments between dividend stocks and bonds, you can create a well-rounded portfolio that generates consistent income while managing risk.

Creating and selling digital products

In today’s digital age, creating and selling digital products has emerged as a lucrative source of passive income. Whether it’s e-books, online courses, or software applications, digital products can be created once and sold repeatedly without significant ongoing effort. This scalability makes them an attractive option for those looking to generate income passively.

With the right marketing strategies and platforms, you can reach a global audience and tap into various niches. To succeed in this realm, it’s crucial to identify a target market and understand their needs. Conducting thorough research will help you create products that resonate with potential customers.

Once your digital product is developed, platforms like Amazon Kindle Direct Publishing or Udemy can help you distribute it effectively. Additionally, leveraging social media and email marketing can drive traffic to your offerings, increasing sales without requiring constant attention. By investing time upfront in creating high-quality digital products, you can enjoy ongoing revenue with minimal maintenance.

Building a blog or YouTube channel for passive income

Starting a blog or YouTube channel can be an exciting way to generate passive income while sharing your passions and expertise with the world. Both platforms allow you to create content that attracts an audience over time. As your following grows, you can monetize your content through various means such as affiliate marketing, sponsored posts, or ad revenue.

The key is to produce valuable content consistently that resonates with your audience. While building a blog or YouTube channel requires initial effort in terms of content creation and audience engagement, the long-term benefits can be substantial. Once your content is established and indexed by search engines or recommended by algorithms, it can continue to attract viewers and generate income long after it’s published.

Additionally, diversifying your monetization strategies—such as offering merchandise or exclusive memberships—can further enhance your earning potential. With dedication and creativity, you can turn your passion for writing or video creation into a sustainable source of passive income.

Peer-to-peer lending as a passive income stream

Peer-to-peer (P2P) lending has gained popularity as an innovative way to earn passive income by connecting borrowers directly with lenders through online platforms. By lending money to individuals or small businesses in exchange for interest payments, you can earn returns that often exceed traditional savings accounts or bonds. P2P lending platforms typically assess borrower creditworthiness, allowing you to make informed decisions about where to invest your money.

One of the advantages of P2P lending is its accessibility; you don’t need significant capital to get started. Many platforms allow you to invest small amounts across multiple loans, diversifying your risk while still generating returns.

Conducting thorough research on different platforms and understanding their fee structures will help you make informed choices that align with your financial goals. With careful management and diversification, P2P lending can become a valuable addition to your passive income portfolio.

Renting out property or space for passive income

Renting out property or space is another effective way to generate passive income. Whether it’s a spare room in your home through platforms like Airbnb or an entire property, short-term rentals have become increasingly popular among travelers seeking unique accommodations. This approach allows you to capitalize on unused space while earning extra cash without committing to long-term tenants.

In addition to short-term rentals, consider renting out storage space or even parking spots if you live in a high-demand area. Many people are willing to pay for convenient storage solutions or parking options close to their destinations. The key is to assess your available resources and market them effectively.

By providing excellent service and maintaining your property well, you can build a positive reputation that attracts repeat customers and referrals. With minimal ongoing effort after the initial setup, renting out space can become a reliable source of passive income.

The importance of diversifying passive income streams

Diversifying your passive income streams is crucial for building financial resilience and reducing risk. Relying on a single source of income can leave you vulnerable if that stream dries up due to market fluctuations or unforeseen circumstances. By spreading your investments across various avenues—such as real estate, stocks, digital products, and more—you create a safety net that ensures stability even when one area underperforms.

Moreover, diversification allows you to tap into different markets and opportunities that may arise over time. As trends change and new technologies emerge, being open to exploring various passive income avenues will enable you to adapt and thrive in an ever-evolving landscape. By continuously educating yourself about different investment options and staying informed about market trends, you can make strategic decisions that enhance your overall financial health.

Ultimately, diversifying your passive income streams not only protects your wealth but also positions you for long-term success in achieving financial freedom.

If you’re interested in learning more about passive income streams, you should check out this article on MoneyCheck. They provide valuable insights and tips on how to start generating passive income through various channels. Whether you’re looking to invest in real estate, start a blog, or create an online course, MoneyCheck has you covered with practical advice and strategies to help you succeed. Don’t miss out on this informative resource to help you achieve financial freedom.

FAQs

What is passive income?

Passive income is income that is earned with little to no effort on the part of the recipient. It is typically generated from assets or activities in which the individual is not actively involved.

What are some examples of passive income streams?

Some examples of passive income streams include rental income from real estate, dividends from stocks, interest from savings accounts or bonds, royalties from intellectual property, and income from affiliate marketing or online courses.

Why is passive income important?

Passive income is important because it can provide financial stability and freedom. It allows individuals to generate income without being tied to a traditional 9-5 job, and can provide a source of income during retirement.

Can anyone start a passive income stream?

Yes, anyone can start a passive income stream. It may require some initial effort and investment, but there are many options available for individuals to generate passive income.

Are passive income streams guaranteed to be successful?

No, passive income streams are not guaranteed to be successful. Like any investment or business venture, there is a level of risk involved. It’s important to research and carefully consider any passive income opportunity before investing time and money into it.

How much money can be made from passive income streams?

The amount of money that can be made from passive income streams varies depending on the individual’s investment, the type of passive income stream, and market conditions. Some passive income streams may generate a small amount of income, while others have the potential to generate significant wealth.

What are some tips for starting a passive income stream?

Some tips for starting a passive income stream include researching different opportunities, diversifying income streams, investing in education or training, and being patient and persistent in building passive income over time.